Editor's Choice

The SEC suspends the lawsuit against Geosyn Mining and its executives amid similar fraud charges and the use of client funds by federal prosecutors

The SEC has suspended the lawsuit against the cryptocurrency mining company Geosyn Mining and its executives, after similar charges were brought against them by federal prosecutors. The SEC’s lawsuit claims that the company’s executives defrauded investors of $5.6 million by selling unregistered securities. They are also accused of using client funds for personal purposes and falsifying reports. The legal proceedings were suspended amid the criminal case and political statements about relaxing the regulation of the cryptocurrency market.

CZ donated 150 BNB to support students in Argentina affected by the collapse of the LIBRA token, complementing EnHeng’s $50,000 fund to compensate for financial losses

The founder of Binance, Changpeng Zhao (CZ), donated 150 BNB (about $100,000) to help students in Argentina affected by the collapse of the LIBRA token. This contribution will complement the $50,000 relief fund established by EnHeng. The token collapse occurred after its endorsement by Argentine President Javier Milei, leading to a sharp drop in its value. The relief fund is aimed at students who lost funds. To receive financial support, applicants must submit a request specifying their educational institution and provide a photo of their student ID.

The Japanese company Metaplanet raised $25.9 million through bonds to expand its Bitcoin reserves, with a plan to reach 21,000 BTC by 2026 and protect against economic risks

The Japanese company Metaplanet Inc. raised $25.9 million through the issuance of zero-interest bonds to expand its Bitcoin reserves, with the goal of reaching 21,000 BTC by 2026. The funds will be used to protect against economic risks in Japan, including high debt and the depreciation of the yen. Metaplanet started actively investing in Bitcoin in 2024, and by the beginning of 2025, it owns 1,761.98 BTC. The company also plans to increase its reserves to 10,000 BTC by the end of 2025, which has already yielded significant profits. Metaplanet will be included in the MSCI Japan index, which will increase institutional investors' interest.

Argentine President Javier Milei under fire for supporting the cryptocurrency $LIBRA, which lost nearly all of its value; opposition demands impeachment

Argentine President Javier Milei found himself at the center of a scandal after publicly supporting the cryptocurrency $LIBRA, which soon lost nearly all of its value. Opposition leaders are calling for his impeachment, claiming that he recklessly supported a risky and unreliable investment. After a sharp rise in the token's value to 5 dollars, its price collapsed below 1 dollar, raising concerns about possible fraud. Milei deleted the post and stated that he was not aware of the project's details, discontinuing its promotion immediately after the incident.

Indian authorities seized cryptocurrency worth $190 million as part of the investigation into the fraudulent BitConnect scheme that attracted over $2.4 billion from investors

The man was arrested for the Hollywood sign stunt, promoting the cryptocurrency Vigilante Token, after the token’s price surged sharply

South Korea lifts ban on institutional investments in cryptocurrencies: FSC allows companies to open accounts on crypto exchanges and participate in the virtual asset market

Brent Kovar is accused of creating a cryptocurrency pyramid worth $24 million, promising high returns and a 100 percent return, while using investors' funds for personal purposes.

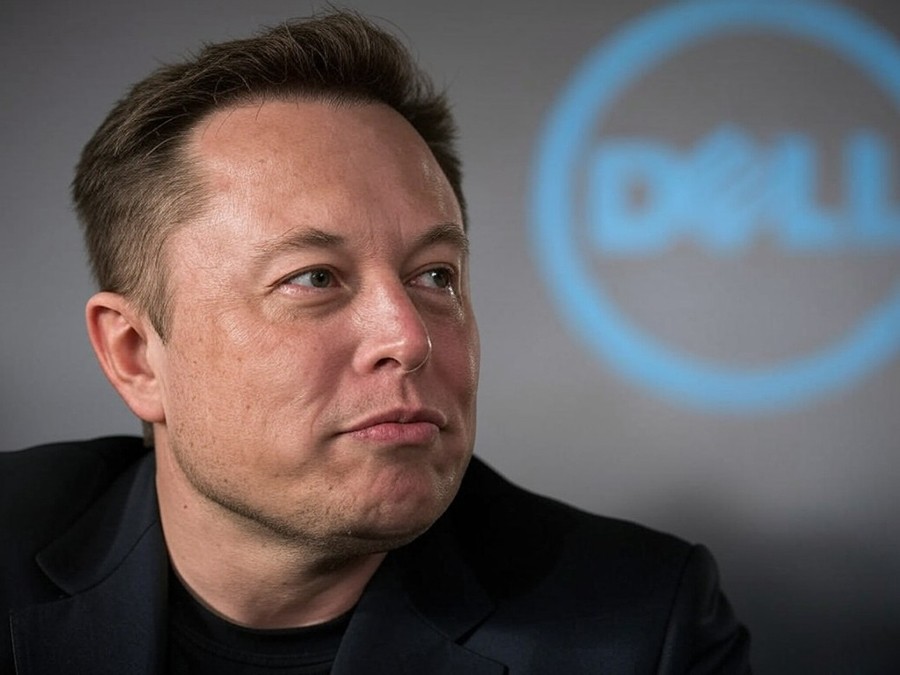

Dell shares rose by 4 percent after reports of a deal with xAI of Elon Musk to purchase $5 billion worth of AI servers with delivery in 2025

Bitget obtains a VASP license from Bulgaria, expanding its cryptocurrency services in the EU and enhancing compliance with international regulations for user security

Tether is actively collaborating with U.S. lawmakers to shape new regulations for stablecoins, including requirements for reserves and monthly audits

West Virginia has proposed a bill for investment in digital assets, including Bitcoin, to create reserves and protect against inflation and budget deficits

The SEC is discussing cryptocurrency regulation with industry leaders, including Blockchain Association and Nasdaq, covering topics such as staking and standards for ETP and cryptocurrency exchanges

The SEC held meetings with representatives of the crypto industry, including Blockchain Association and Nasdaq, to discuss the regulation of digital assets. Key topics included staking requirements, creating clear standards for cryptocurrency products and exchanges, and improving the regulation of ETP. The Blockchain Association proposed clarifying that staking is not a security and providing clear rules for brokers and exchanges. These steps are aimed at developing the legal framework for cryptocurrencies and their integration into the traditional financial system.

Bybit removed from AMF blacklist after two years of cooperation with French regulators, the company aims to obtain a MiCA license for operations in the EU despite challenges in other countries

The cryptocurrency exchange Bybit is no longer on the blacklist of the French financial authority AMF after two years of review. On February 14, Bybit's CEO, Ben Zhou, announced that the company had successfully resolved all issues with the French regulators, ensuring compliance with their requirements. AMF confirmed that the exchange is no longer listed as "unauthorized." Bybit is also working towards obtaining a license under the MiCA Regulation for cryptocurrency assets, which will allow it to expand operations within the EU. However, the company continues to face regulatory challenges in other countries.

Tether, the leading issuer of stablecoins, acquires a minority stake in the Juventus football club: the club's stock rose by 2.5 percent, and the fan token skyrocketed by 200 percent after the announcement of the deal

Tether's investment division acquired a minority stake in the Juventus football club. As a result, the club's stock rose by 2.5 percent, and its fan token skyrocketed by 200 percent. Tether's CEO, Paolo Ardoino, stated that the company intends to integrate innovative technologies such as digital assets, artificial intelligence, and biotechnology into the sports industry. This investment reflects Tether's strategy to expand beyond stablecoins and actively participate in other high-tech fields.

The President of the United States, Donald Trump, signed a decree on reciprocal tariffs on goods with partners to reduce costs and stimulate the growth of the U.S. economy

The President of the United States, Donald Trump, signed a decree introducing reciprocal tariffs on goods from partner countries. This move is aimed at strengthening the trade position of the United States and reducing costs for American manufacturers. The tariffs will be introduced after a report is prepared, which should be ready by April 1. If tariffs are reduced by other countries, it will lead to lower prices in the U.S. and increased production. The decree is part of a broader trade strategy aimed at improving the economic situation and stimulating growth in the U.S. economy.

Best news of the last 10 days

A federal court suspends the SEC's lawsuit against Binance for 60 days to develop a regulatory framework for digital assets, following a joint motion from the parties

Estonian co-founders of the crypto scheme Hashflare pleaded guilty to fraud amounting to 577 million dollars, agreeing to return more than 400 million for compensation to investors

The FBI has prevented cryptocurrency frauds worth $285 million as part of Operation "Level Up," helping over 4,300 victims avoid losses since January 2024

Elon Musk will audit NASA through the DOGE department, which raises concerns about conflicts of interest and the impact on contracts, including the Artemis program and SLS

South Korea will allow charitable organizations, universities, and cryptocurrency exchanges to sell cryptocurrency in 2025 amid rising institutional demand

South Korea will allow charitable organizations, universities, and cryptocurrency exchanges to sell cryptocurrency in the first half of 2025. The Financial Services Commission (FSC) stated that this decision is based on the growing demand for institutional cryptocurrency trading. Starting from April, institutions will be able to sell crypto assets received as donations or commissions to cover operating expenses. FSC is also planning a pilot project for 3,500 companies and professional investors.

Explosion due to illegal Bitcoin mining in Malaysia: electricity theft losses amount to $763 million since 2018, authorities strengthen measures against violations

A blast occurred in Malaysia due to an illegal Bitcoin mining operation connected to an illegal power grid hookup. As a result of the incident, nine mining rigs and other equipment were seized. This situation highlights the growing problem of illegal crypto mining, which has caused damage amounting to more than $763 million since 2018. Malaysian authorities are tightening measures against illegal electricity usage and applying new technologies to detect such violations in order to protect the country’s power grid.

Texas has proposed a bill to create a Strategic Bitcoin Reserve, which will allow investment in cryptocurrencies to strengthen the state's financial security

The SB 21 bill in Texas, proposed by Senator Charles Schwertner, aims to create a Strategic Bitcoin Reserve. It will allow the state to invest in Bitcoin and other cryptocurrencies with a market capitalization of more than 500 billion dollars. The goal is to enhance financial security and economic stability in the region. The bill provides the ability to manage cryptocurrency assets and use them as a strategic resource. This initiative is supported by Texas authorities as a priority, emphasizing its significance for the state's future financial development.

Elon Musk changes his name to "Harry Bōlz" on X, causing the HARRYBOLZ meme token to rise by 127 percent and increasing its market capitalization to 17.35 million dollars

Elon Musk once again influenced the cryptocurrency market by changing his name on the X social network to "Harry Bōlz". This move caused a sharp rise in the price of the meme token HARRYBOLZ, which grew by 127 percent, reaching a market capitalization of 17.35 million dollars. The token, built on the Solana blockchain, was relatively unnoticed before this change, but its price significantly increased afterward. This is not the first time Musk's actions have triggered turmoil in the crypto market. Previously, his name change to "Kekius Maximus" caused a similar rise in another meme coin. It is important to note that such changes can be temporary, highlighting the risks associated with investing in meme tokens.